US Elections and the State of National Debt: A Comparative Analysis

As the US election approaches, the spotlight is increasingly turning towards the economic plans proposed by candidates. This article explores the implications of national debt in both the US and UK, highlighting the projected fiscal trends that could shape the future of public finances.

Introduction

The economic landscape is a critical focus as the 2024 US elections draw near, with candidates outlining their plans to address national debt and public finances. In the UK, a similar scrutiny is placed on the state of public finances, particularly concerning national debt as a percentage of GDP. Understanding the dynamics of national debt is essential, especially when comparing the fiscal responsibilities of the US and UK governments amid changing economic conditions. This article delves into the current state of national debt, projections for the future, and the potential impacts of various political strategies on fiscal health.

The Current State of National Debt

National debt refers to the total amount of money that a country’s government has borrowed, which is crucial for financing government operations and investments. As of now, the national debt of the UK stands at approximately 100% of its GDP, raising concerns among policymakers and the public alike about the sustainability of such levels. In contrast, the US national debt is projected to rise significantly, with estimates indicating it could reach 125% of GDP in the coming years.

Comparative Analysis of Debt Levels

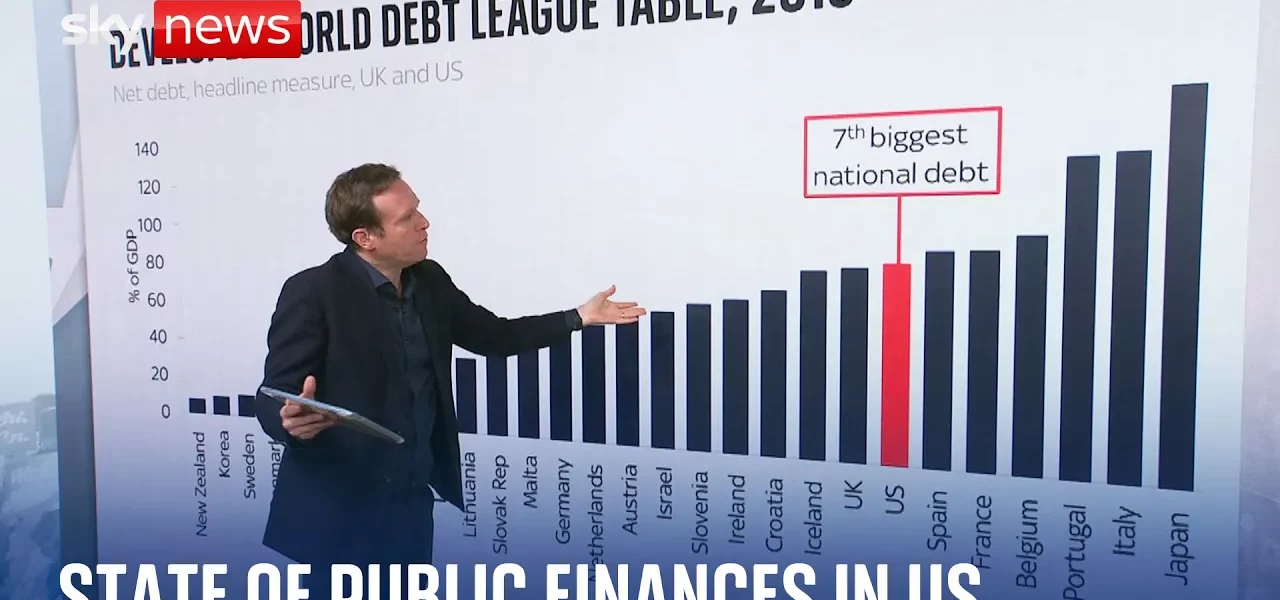

When comparing national debts globally, the figures present a stark contrast:

- Japan has the highest national debt, exceeding 200% of its GDP.

- Italy follows closely behind, with significant debt levels.

- The US, which was previously ranked seventh, is now projected to climb to third place in terms of national debt by the end of this decade.

Projected Fiscal Trends in the US and UK

Looking ahead, the fiscal strategies of the leading candidates in the US elections play a pivotal role in shaping public perception of national debt management. The Biden-Harris administration has been projected to increase national debt further, potentially reaching 133% of GDP by the mid-2020s. In contrast, Donald Trump’s campaign, traditionally seen as fiscally conservative, is also expected to raise debt levels to approximately 142% of GDP.

Key Factors Influencing Debt Projections

Several factors contribute to the rising national debt in both countries:

- Tax Revenues: Lower tax revenues in the US compared to historical averages significantly impact the government’s ability to manage debt.

- Increased Spending: Programs such as Medicare and the Inflation Reduction Act have contributed to higher expenditures.

- Debt Interest Costs: Rising costs associated with servicing existing debt further exacerbate the situation.

Historical Context of National Debt

To understand the current trajectory of national debt, it is essential to consider historical data. Since 1900, the levels of national debt have fluctuated significantly, often correlated with major economic events such as wars and financial crises. For instance, after World War II, the UK’s national debt surged; however, the economic recovery that followed was not without its challenges.

Lessons from History

While historical instances of high national debt can provide some reassurance, they also serve as a cautionary tale:

- Post-war recovery periods often saw prolonged periods of economic stagnation despite high levels of debt.

- Effective fiscal policies and public investment strategies are crucial for sustainable economic growth following periods of high debt.

Conclusion

As we approach the 2024 elections, the implications of national debt in both the US and UK are becoming increasingly critical to the economic discourse. With projections indicating unprecedented levels of debt, the responses from current candidates will significantly influence public finances. It is crucial for voters to consider the long-term impacts of fiscal policies proposed by candidates. To stay informed about ongoing economic developments, be sure to check our articles on related topics.

“`