Understanding the Bank of England’s Monetary Policy and Inflation Trends

In this article, we explore the latest developments in the Bank of England’s monetary policy regarding inflation trends, consumer price index fluctuations, and the potential implications for the economy.

Introduction to the Current Economic Environment

The Bank of England’s Monetary Policy Committee (MPC) is set to convene to discuss the latest inflation figures and interest rate policies. As the nation navigates through the economic landscape shaped by the cost of living crisis and global events, understanding the intricacies of inflation trends becomes crucial. The committee’s decisions, influenced by both core and consumer inflation metrics, have significant implications for consumers and businesses alike.

Current Inflation Trends

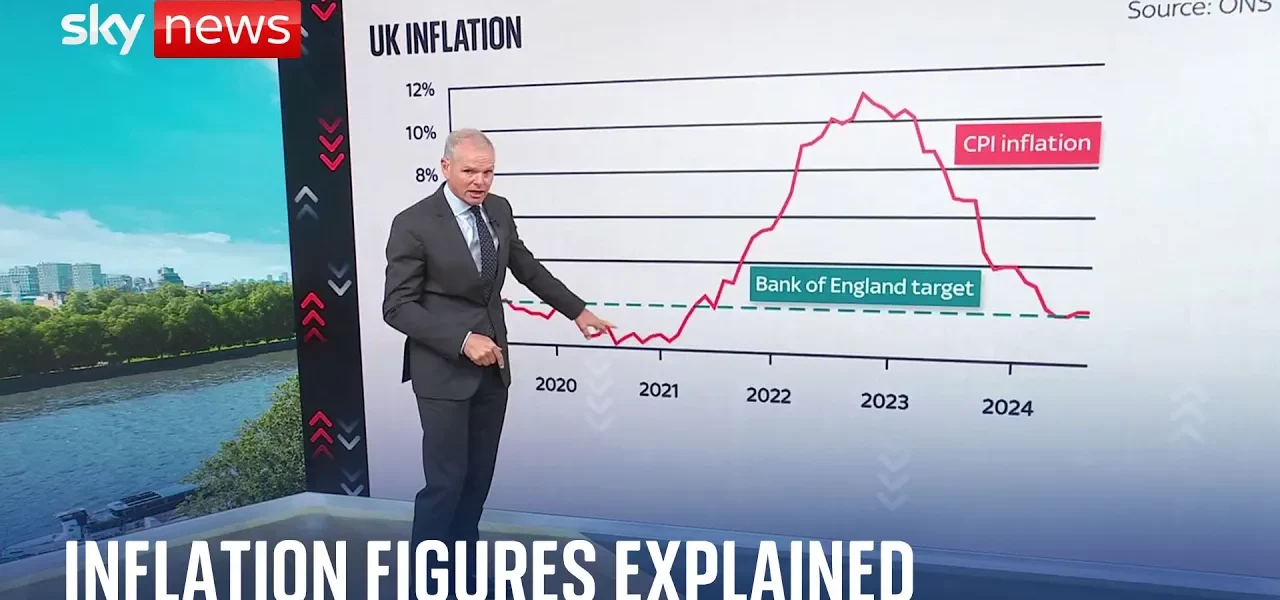

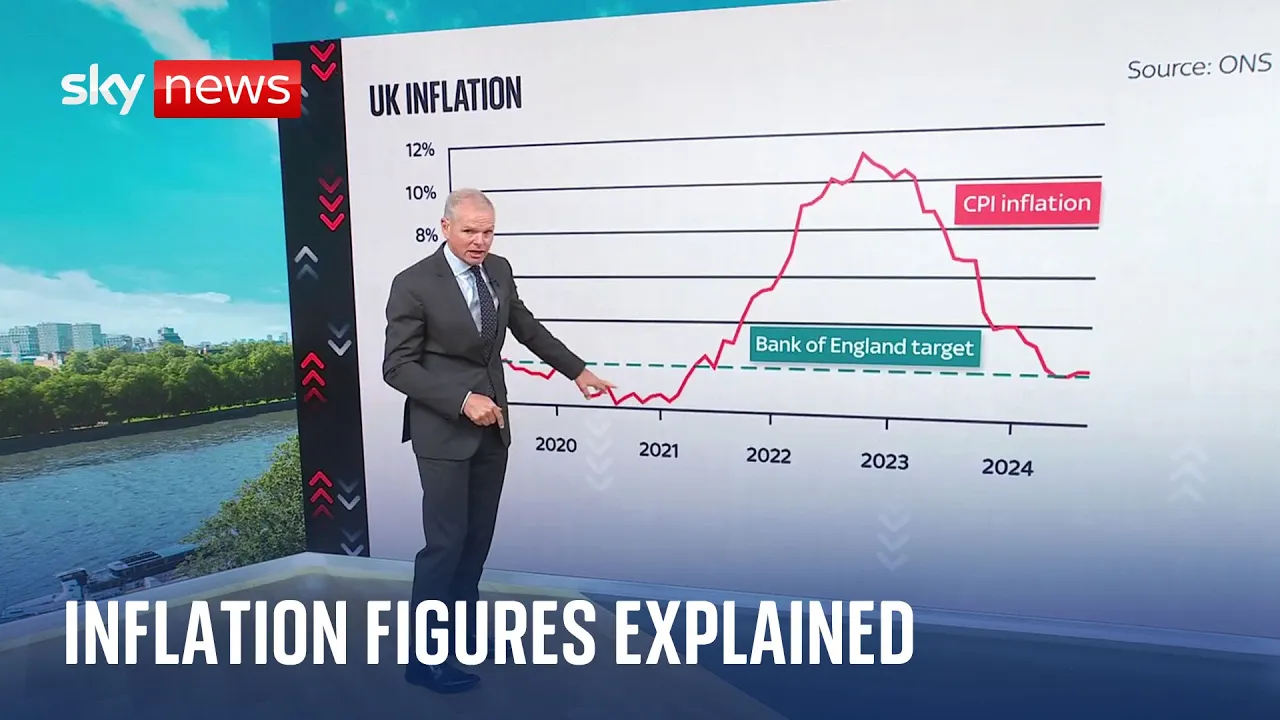

Inflation has been a pressing issue, especially following the economic disturbances caused by the Ukraine war. The Consumer Price Index (CPI) inflation rate hit nearly 12% during the peak of the crisis but has seen a decline, recently stabilizing around the Bank of England’s target of 2%.

Recent CPI Developments

As of August, the CPI inflation rate was reported at 2.2%, indicating a slight upward trend. The Bank of England forecasts this figure could rise to 2.7% in the near future. Here are key points regarding the CPI:

- Inflation peaked at nearly 12% during the cost of living crisis.

- Recent figures showed a return to 2% in June and July.

- The latest report in August confirmed a slight rise to 2.2%.

Understanding Core Inflation

Core inflation is a critical component that helps economic analysts gauge the underlying inflationary pressures in the economy. It excludes volatile items such as food and energy prices, offering a clearer view of price stability.

Components of Core Inflation

As reported, core inflation was measured at 3.6% in August, showing a continued rise. Factors influencing this increase include:

- Goods Inflation: Surprisingly, goods inflation has decreased by 0.9%, suggesting that many consumer goods are actually becoming cheaper.

- Services Inflation: In contrast, services, which represent 80% of the UK economy, have seen inflation rates above 5%, contributing significantly to core inflation.

The Bank of England’s Response

The Bank of England is cautious in its approach to adjusting interest rates due to the persistent core inflation. Despite a recent cut in rates by a quarter percent, market analysts suggest that there is only a 25% chance of another cut in the upcoming meeting.

Interest Rate Projections

Current expectations indicate that the interest rate will be held at 5% until the next meeting in November, with potential reductions projected for 2024:

- Interest rates expected to decrease to 3.5% by the end of next year.

- Market sentiment anticipates a cautious approach to avoid exacerbating inflationary pressures.

Global Economic Context

The Bank of England’s policies are not occurring in isolation. Other central banks, such as the Federal Reserve in the US and the European Central Bank, are also adjusting their monetary policies in response to global inflation trends.

Comparative Policy Adjustments

Recent developments include:

- The Federal Reserve is poised to cut interest rates, although the extent of the cut (quarter point or half point) remains under discussion.

- The European Central Bank reduced rates last week, highlighting a coordinated effort among developed economies to combat inflation.

Conclusion

In summary, the Bank of England faces significant challenges as it navigates through fluctuating inflation rates and varied economic pressures. The delicate balance of managing interest rates while addressing core inflation is crucial for achieving a soft landing for the economy. As consumers and businesses prepare for potential changes, staying informed about these developments is essential. For further insights on monetary policy and economic trends, explore our related articles on the subject.

“`