UK Economy and Politics: Analyzing Inflation and Consumer Sentiment

This article delves into the current economic situation in the UK, particularly focusing on the impact of inflation on food prices, the hospitality industry, and the broader political implications as the country heads towards a pivotal election.

Introduction

The UK economy is experiencing a complex interplay of inflation dynamics and consumer sentiment, significantly influenced by recent historical events. As inflation rates fluctuate, businesses, particularly in the hospitality sector, are feeling the strain from rising costs. This article explores how these economic factors are shaping public perception and influencing the political landscape in the lead-up to elections.

The State of Inflation in the UK

Inflation has been a persistent concern for the UK economy, especially in light of the COVID-19 pandemic and subsequent supply chain disruptions. The Bank of England’s inflation target has come into focus as statistics indicate a return to more manageable rates.

Recent Trends in Inflation

According to recent data, inflation has dropped to the Bank of England’s target level, suggesting a potential easing of the cost-of-living crisis. Key highlights include:

- Inflation rates have stabilized, with some areas showing a decrease.

- Food prices, specifically fish, have seen a notable decline compared to pre-pandemic levels.

- Fresh produce prices have remained steady, which is encouraging for consumers.

Impact on the Hospitality Sector

The hospitality industry, one of the sectors hardest hit by the pandemic, is beginning to recover as food inflation stabilizes. However, challenges remain.

Cost Pressures on Businesses

Business owners in the hospitality sector are grappling with various cost pressures:

- Energy Costs: Rising utility prices continue to squeeze profit margins.

- Labor Costs: Increased wages and labor shortages are impacting operational costs.

- Food and Drink Costs: Fluctuations in supply chain costs affect pricing strategies.

Despite these challenges, a decline in inflation is viewed positively by many in the industry, offering a glimmer of hope for recovery.

Consumer Sentiment and Political Implications

As inflation rates stabilize, consumer sentiment remains a crucial indicator of economic health. Feedback from the public reveals a mixed outlook.

Public Perspectives on Inflation

Many consumers express skepticism about the impact of falling inflation on their daily lives:

- Consumers report that prices for essentials like food and clothing are still significantly higher than three years ago.

- Wage stagnation continues to erode purchasing power, leaving many feeling financially stressed.

- There is a widespread belief that while inflation may be decreasing, the overall cost of living remains burdensome.

Political Ramifications

As the elections approach, the implications of economic conditions on political campaigns become increasingly significant:

- Political leaders are using the narrative of falling inflation as a point of campaign strategy.

- The opposition is capitalizing on public dissatisfaction with the current government’s handling of the economy.

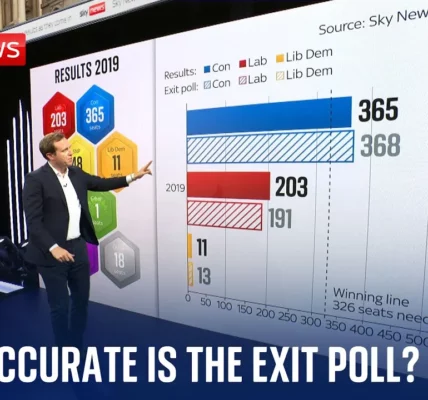

- Polling data suggests a potential shift in power, with labor projected to gain significant seats.

Conclusion

The current economic landscape in the UK is characterized by a complex interplay between inflation, consumer sentiment, and political dynamics. While falling inflation is a welcome development, many households continue to feel the strain of elevated living costs. As the nation prepares for upcoming elections, the political ramifications of these economic conditions will likely play a critical role in shaping the future of the UK. It remains essential for consumers to stay informed and engaged with the political discourse surrounding these issues.

For further insights into how these economic factors may affect your financial planning, explore our related articles on cost of living adjustments and navigating inflation in daily expenses.

“`