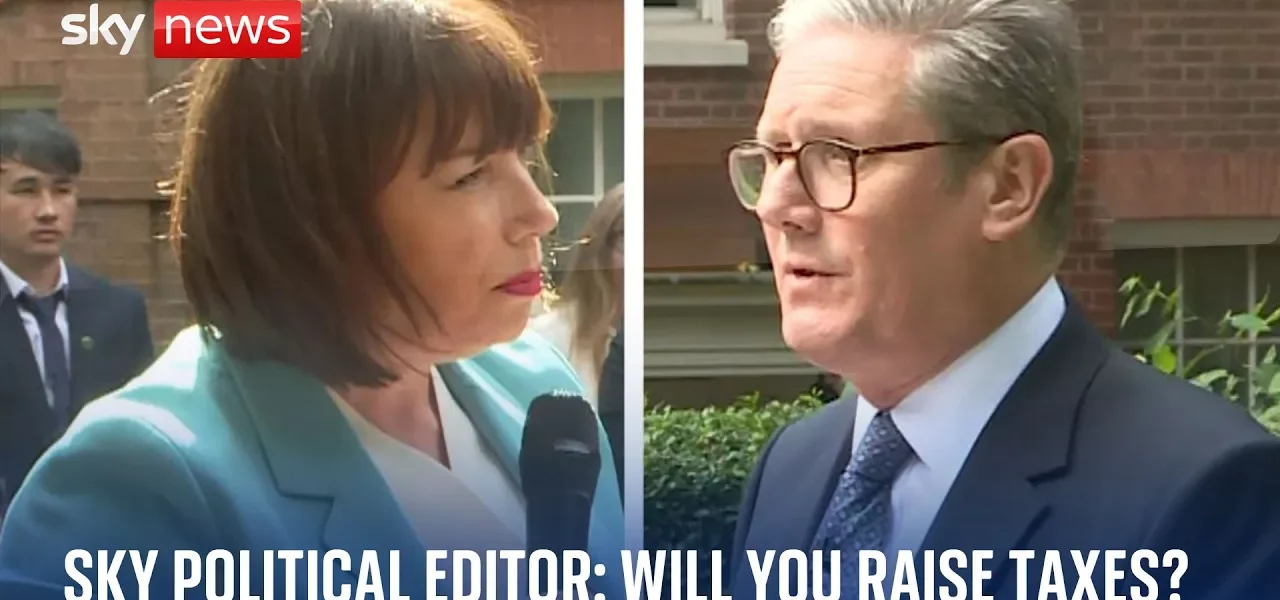

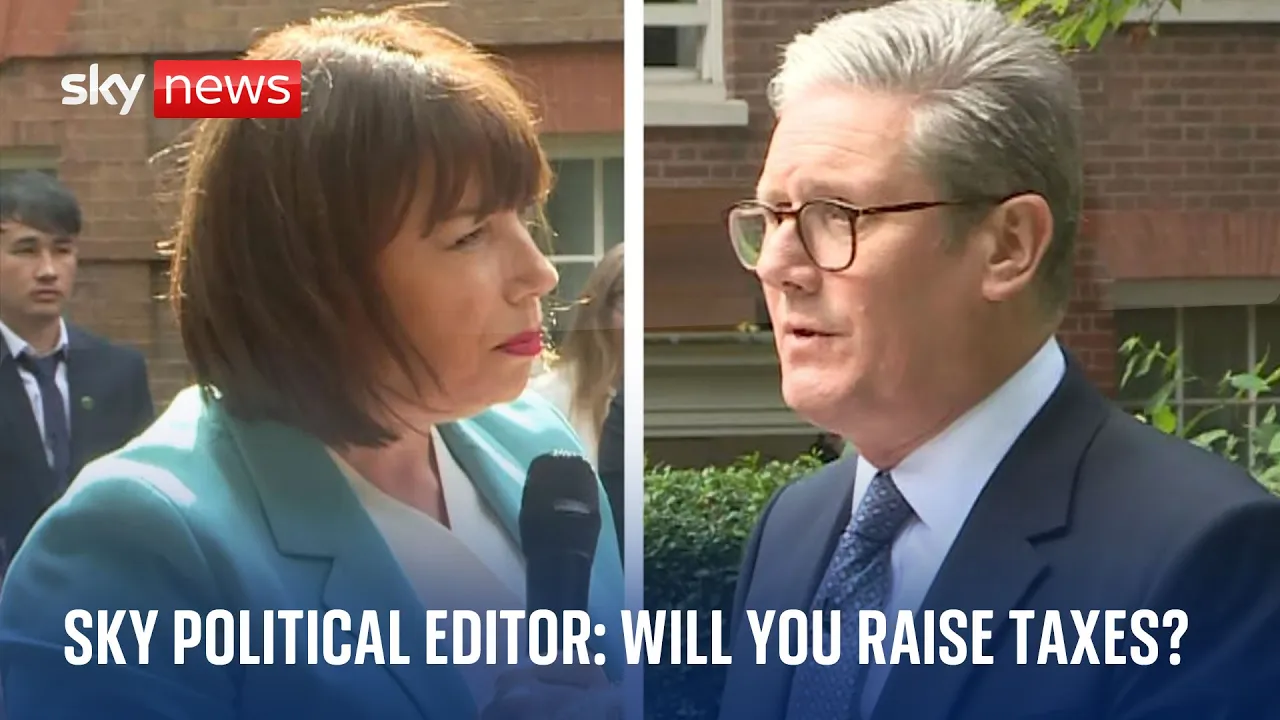

K. Starmer’s Speech: Promises, Economic Actions, and Tax Implications

This article delves into the significant points from K. Starmer’s recent speech, highlighting his commitments to economic growth, the implications for taxpayers, and the government’s strategic plans moving forward.

Introduction

K. Starmer’s recent address has sparked widespread discussion, particularly regarding his commitment to fulfilling election promises and addressing the economic challenges facing the UK. With a new slogan emblazoned on the podium, “Fixing the Foundations,” Starmer articulated a vision for growth and stability. He claimed that his government has achieved more in just seven weeks than the previous administration did in seven years, highlighting a stark contrast in leadership styles. However, alongside these ambitious claims, he also warned of the impending financial challenges, including potential tax increases. This article aims to dissect these key messages, providing clarity on the government’s future actions and their implications for citizens.

Key Elements of the Speech

Starmer’s speech comprised two primary elements: a declaration of action and a warning about the economic pain ahead. Below, we will explore these components in detail.

Commitment to Action

Starmer emphasized the government’s proactive stance on several initiatives aimed at economic recovery and development. The following points summarize his commitments:

- Unlocking Planning Growth: A focus on reviewing and enhancing planning regulations to stimulate construction and development.

- Great British Energy Initiative: A strategic plan to establish a sustainable energy sector that can support economic growth.

- Immediate Actions Taken: Starmer claimed that significant actions have already been undertaken within seven weeks of his leadership.

Addressing Financial Pain

While outlining his government’s achievements, Starmer did not shy away from discussing the financial difficulties that lie ahead. Key points include:

- Tax Increases: Acknowledgment that taxes will have to rise, with implications for various demographics.

- Pensioners Affected: The decision to scrap the winter fuel allowance for many pensioners has already drawn criticism.

- Transparency with the Public: Starmer stressed the need for honesty about financial challenges to rebuild trust with citizens.

The Implications of Tax Increases

Starmer’s remarks regarding tax increases have raised pertinent questions about who will be most affected. He indicated that the government aims to avoid burdening working people but left open the possibility of wealth taxes. Below are some critical considerations:

Potential Tax Increases and Their Impact

Starmer reiterated his campaign promise of not increasing income tax, VAT, or National Insurance for working individuals. However, the conversation about wealth taxes suggests a broader strategy:

- Wealth Taxes: Possible levies on higher income brackets, shareholders, and large businesses.

- Working Individuals: Assurance that taxes on average earners will not increase, but the definition of ‘working individuals’ remains ambiguous.

Public Reaction and Trust Issues

The government’s recent decisions, especially regarding pensioners, have led to skepticism among voters. Starmer’s need to address these concerns is critical for maintaining public trust:

- Pensioner Trust: Many pensioners who voted for the government feel betrayed by the sudden cuts to their allowances.

- Electoral Promises: The inconsistency in tax promises has left voters questioning the government’s reliability.

Conclusion

K. Starmer’s speech encapsulated a blend of optimism regarding government initiatives and a sobering reminder of the economic challenges ahead. The commitment to fixing the foundations of the economy is commendable, yet the implications of tax increases raise significant concerns for citizens, particularly pensioners. As the government prepares for the upcoming budget, transparency and accountability will be key in restoring trust among the electorate. Moving forward, it is crucial for Starmer and his administration to communicate clearly about future tax policies and economic strategies to ensure that the public is well-informed and engaged. For more insights on economic policies and their implications, be sure to explore our related articles on governmental actions and economic growth.

“`