Controversial Financial Figures in the Current Election Campaign

This article delves into the current election campaign, exploring the contentious financial figures presented by political parties. We analyze the implications of these figures on households and the broader economic landscape.

Introduction

The ongoing election campaign has quickly become a battleground for financial claims and counterclaims among political parties. With the absence of detailed manifestos, parties are resorting to estimates and projections to critique each other’s spending and tax policies. Central to this discourse is the figure of £2,000 per household, which has sparked significant debate. This article aims to explore the origins of this figure, the underlying assumptions, and the broader implications for voters and the economy.

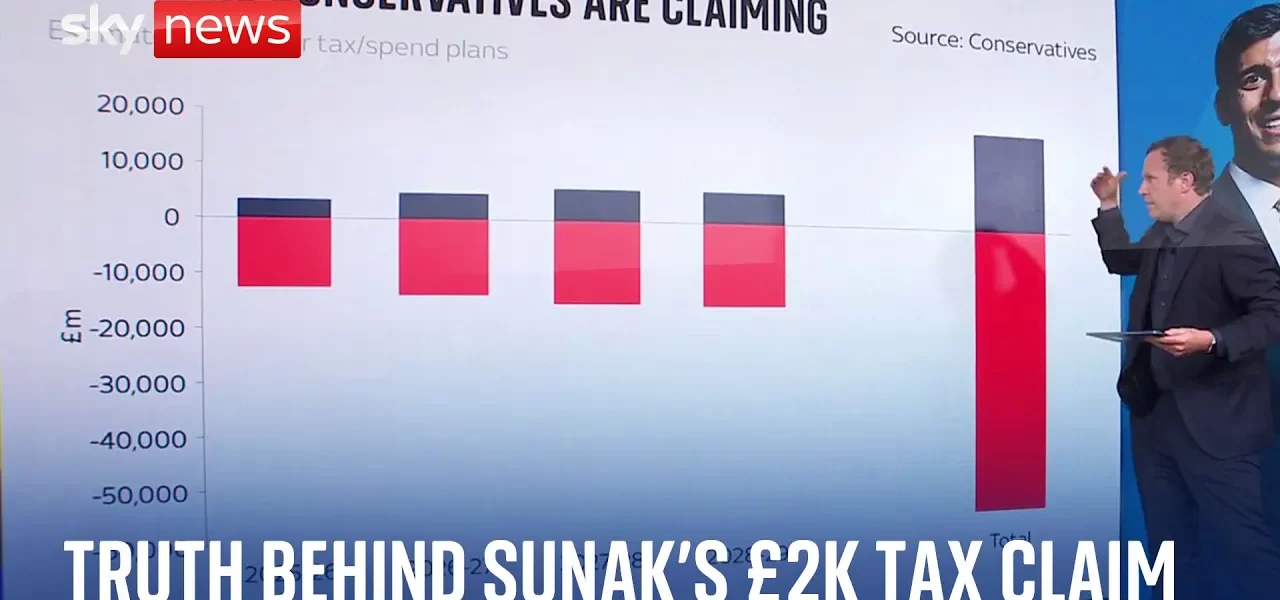

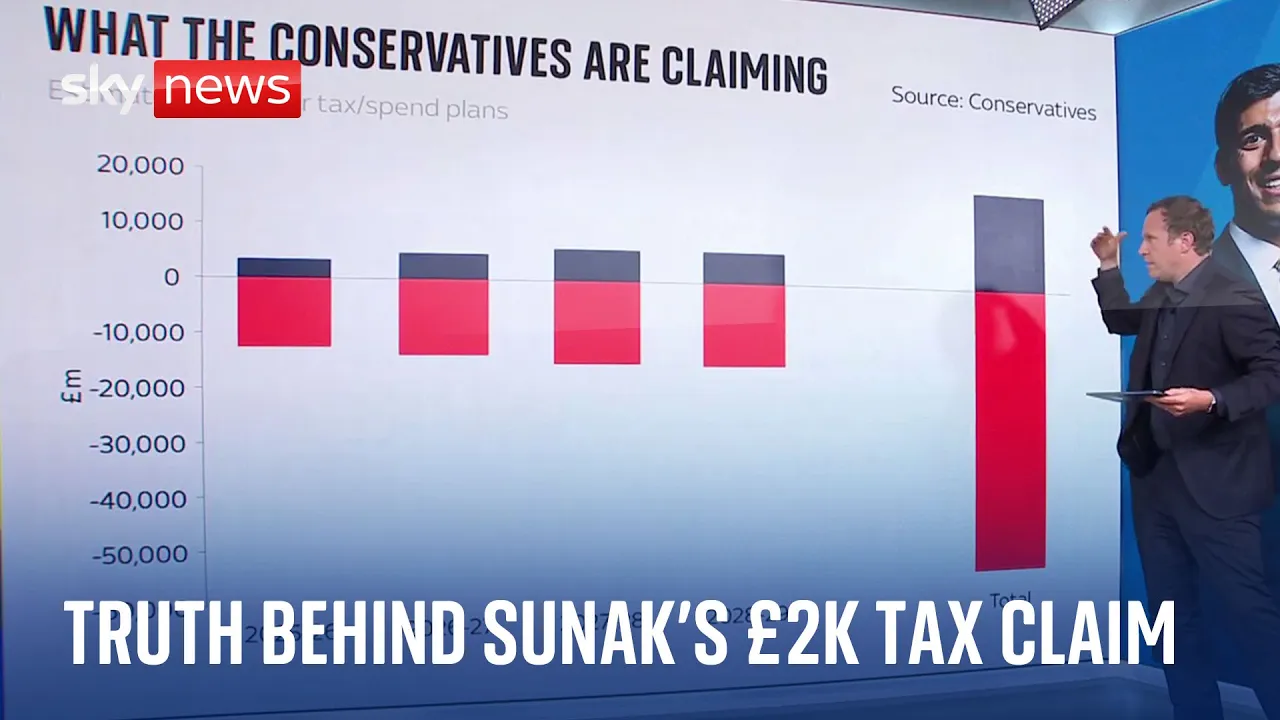

The Origin of the £2,000 Figure

The figure of £2,000 per household, frequently cited by Prime Minister Rishi Sunak, is derived from a dossier produced by the Conservative Party. This dossier, released last month, attempts to project the potential spending and taxation policies of the Labour Party should they come to power.

Understanding the Dossier

The Conservative dossier utilizes statistical data from the Treasury to estimate Labour’s proposed spending over the next four years. The analysis suggests that Labour’s plans would result in an additional £10 billion in yearly spending without a clear outline of how these costs would be funded.

- The document highlights key initiatives like the Green Prosperity Plan.

- It points out potential tax increases, including VAT and business rates on private school fees.

- Ultimately, it concludes that there is a funding gap, or a ‘black hole,’ of £38.5 billion, which translates to approximately £2,294 per household.

Labour’s Response to the Conservative Claims

In response, Labour has raised several objections regarding the accuracy and validity of the Conservative calculations. They argue that the Treasury’s figures may not accurately reflect the anticipated costs associated with their initiatives.

Key Points of Contention

Among Labour’s arguments are the following:

- Disagreement on the projected costs of Neighborhood Health Centers.

- Questioning the estimates related to ‘insourcing’ expertise into government.

- Concerns about the appropriateness of Treasury-derived figures used in political debates.

The Letter from the Treasury

Adding to the complexity, a letter from James Bowler, the head of the Treasury, has indicated that costings derived from external sources should not be presented as official Treasury estimates. This raises questions about the integrity of the financial claims being made during the campaign.

The Broader Tax Burden

Labour also contends that the Conservative government has already imposed significant tax increases during their current term, arguing that these should also be factored into the financial discourse surrounding the election.

Tax Increases Over the Current Parliament

Labour calculates that the cumulative tax burden over the past Parliament amounts to £13,000 per household. This figure, they argue, should be considered when evaluating the current financial claims.

Labour’s Counter-Dossier

In a bid to counter the Conservative narrative, Labour produced their own dossier, which attempts to highlight what they perceive as a larger financial gap in Conservative plans. Key points include:

- Accusations that the Conservatives plan to scrap National Insurance and other significant taxes.

- Claims that the Conservatives are misleading voters about the feasibility of their proposals.

- Estimates indicating a potential black hole of £4,000 per household based on Conservative spending plans.

The Conservative’s New Dossier

In reaction to Labour’s dossier, the Conservatives released a new document that presents even more extreme estimates regarding the financial implications of Labour’s potential policies.

Key Highlights of the Conservative Dossier

This new dossier suggests that under Labour policies, households could face financial impacts amounting to £46,000 each year. Some points included in this document are:

- Proposals to cut corporation tax to 12.5%.

- Speculation about scrapping business rates altogether.

- Controversial claims about Labour’s economic strategies that are deemed unrealistic by many observers.

Conclusion

The current election campaign is marked by a proliferation of complex financial claims that are often based on speculative estimates rather than concrete proposals. The figure of £2,000 per household has become a focal point for both parties, leading to a war of dossiers and counterclaims. As voters prepare to make informed decisions, it is crucial to scrutinize these figures critically.

For further insights into the implications of these financial debates, check out our related articles on tax policies and budget analysis. Stay informed and engaged as the election unfolds!

“`