The Total Tax Burden in the UK: An In-Depth Analysis

In this comprehensive article, we delve into the total tax burden faced by UK citizens, considering all aspects of taxation including National Insurance and income tax. With current trends indicating a rising tax burden, we explore historical data, government policy implications, and the broader economic context.

Introduction

The tax burden in the UK encompasses various forms of taxation that citizens are required to pay. This includes not only income tax and National Insurance but also other taxes that collectively contribute to the nation’s fiscal landscape. Understanding this burden is crucial, especially in light of recent data that suggests an increase in tax obligations due to government spending and economic pressures. This article seeks to provide a detailed analysis of the total tax burden in the UK, tracing its historical trends, current government policies, and their implications for the future.

Historical Context of the Tax Burden

To comprehend the current tax burden, it is essential to look back at historical data. The total tax burden as a percentage of GDP has varied significantly over the decades, influenced by economic conditions, government policies, and global events.

The Impact of Major Events

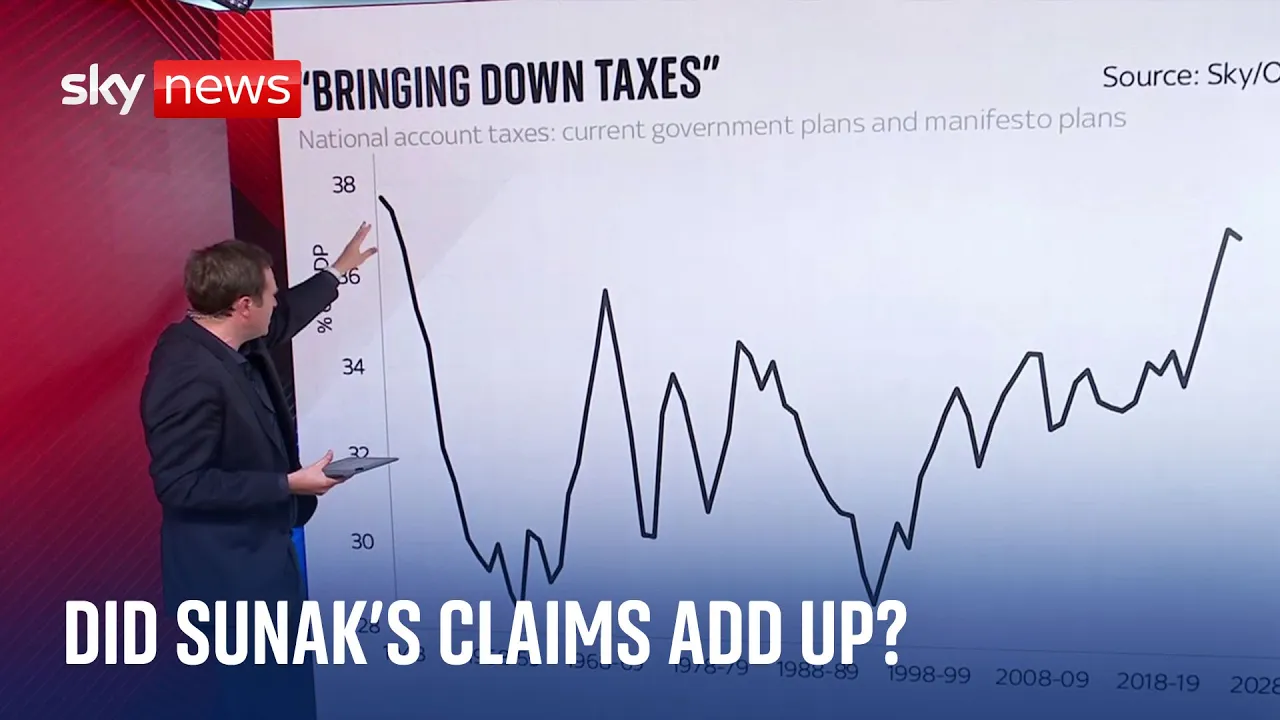

The graph of tax burdens shows notable spikes during significant historical events:

- Post-War Era (1945): Following World War II, the tax burden reached unprecedented levels as the government sought to rebuild the economy.

- The Financial Crisis (2008): Increased government spending during the financial crisis also led to a rise in the tax-to-GDP ratio.

- COVID-19 Pandemic: The pandemic necessitated extraordinary fiscal measures to support the economy, resulting in a sharp increase in the tax burden.

Current Tax Burden Analysis

According to the latest figures from the Office for Budget Responsibility (OBR), the tax burden is on an upward trajectory. The current plans outlined by the Conservative Party indicate a continued rise in taxes, with implications for taxpayers across the country.

Forecasted Trends

- The tax burden is expected to rise steadily, albeit at a slower rate than in previous years.

- The anticipated end of National Insurance cuts may provide temporary relief, but overall, the tax obligations are projected to remain high.

- By the end of the current parliamentary term, the tax burden could reach levels not seen since the 1940s.

Key Factors Influencing Tax Increases

Several factors contribute to the rising tax burden in the UK:

- Frozen Allowances: Many individuals are being pushed into higher tax bands due to frozen income tax thresholds.

- Inflationary Pressures: The cost of living crisis has exacerbated financial strain, leading to calls for increased government revenue.

- Government Spending Needs: Increased demands on public services necessitate higher taxation to fund essential programs.

Inflation and the Cost of Living

Inflation plays a critical role in shaping the economic landscape, affecting the real purchasing power of consumers and influencing the government’s fiscal policies.

Current Inflation Rates

As of now, the annual increase in inflation stands at 2.3%. However, a deeper look reveals a stark contrast in price levels:

- The cost of living has significantly increased over the past few years, with a reported 20% rise in prices since the onset of the crisis.

- This discrepancy highlights the difference between nominal inflation rates and the real impact felt by everyday consumers.

Migration Trends and Their Fiscal Implications

Migration is another critical area of discussion, particularly regarding its impact on taxation and public services.

Net Migration Statistics

Post-Brexit, net migration into the UK has seen fluctuations:

- Initial statistics indicated a rise, which was later revised to show a decrease.

- Government claims of reduced migration must be approached with caution due to potential revisions in the data.

Conclusion

The total tax burden in the UK is a complex and evolving issue that reflects broader economic trends and government policies. As the tax burden continues to rise, it is essential for citizens to stay informed about these changes and their implications. Understanding the relationship between taxation, inflation, and migration will be crucial for navigating the future economic landscape. For further insights into related topics, consider reading our articles on the cost of living crisis and UK tax policy changes.

“`