Understanding the Current Housing Market and Interest Rates in the UK

This article provides an in-depth analysis of the current state of the UK housing market, focusing on recent decisions by the Bank of England regarding interest rates, the impact on housing affordability, and the political landscape surrounding housing supply and demand.

Introduction

The UK housing market is currently facing significant challenges, primarily driven by recent interest rate decisions made by the Bank of England. As political leaders from major parties discuss housing policies, the implications of these decisions on affordability and mortgage payments are becoming increasingly evident. This article aims to dissect the relationship between interest rates and the housing market, explore housing affordability metrics, and evaluate political commitments to housing supply.

Current Interest Rates and Market Predictions

Recently, the Bank of England decided to maintain interest rates at 5.25%, with no immediate cuts in sight. However, market forecasts suggest a potential reduction in rates in the near future. Understanding the dynamics at play here is crucial for homeowners and prospective buyers alike.

Market Reactions to Interest Rate Decisions

The financial markets continuously assess the likelihood of interest rate changes. Following the latest announcement, a notable increase in the probability of a rate cut was observed, rising from approximately 37% to over 60%. This shift indicates market optimism regarding prospective cuts, particularly after the elections.

Impacts on Homeowners

- Rising mortgage interest payments

- Increased financial strain on first-time buyers

- Potential for future cuts to alleviate pressure

Housing Affordability: A Growing Concern

As interest rates remain high, housing affordability has emerged as a pressing issue for many UK residents. Current statistics indicate that mortgage payments are consuming a larger portion of take-home pay, particularly in London.

Current Affordability Metrics

Housing affordability can be measured through various metrics, including mortgage payments as a percentage of income. Notably:

- Mortgage payments are at their highest level since 2008.

- In London, repayments as a percentage of total income have reached levels not seen since 1990.

Regional Variations in Housing Affordability

The disparity in housing affordability across the UK is stark:

- London: Over 15 years required to save for a deposit

- Scotland and Northern England: Approximately 6 years needed

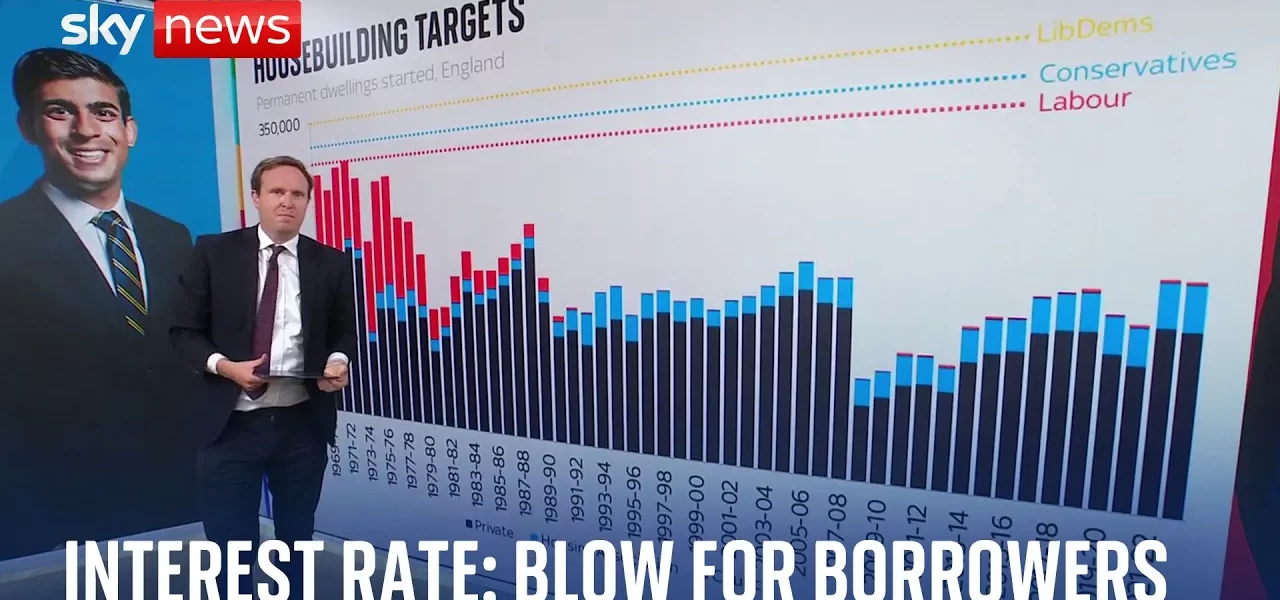

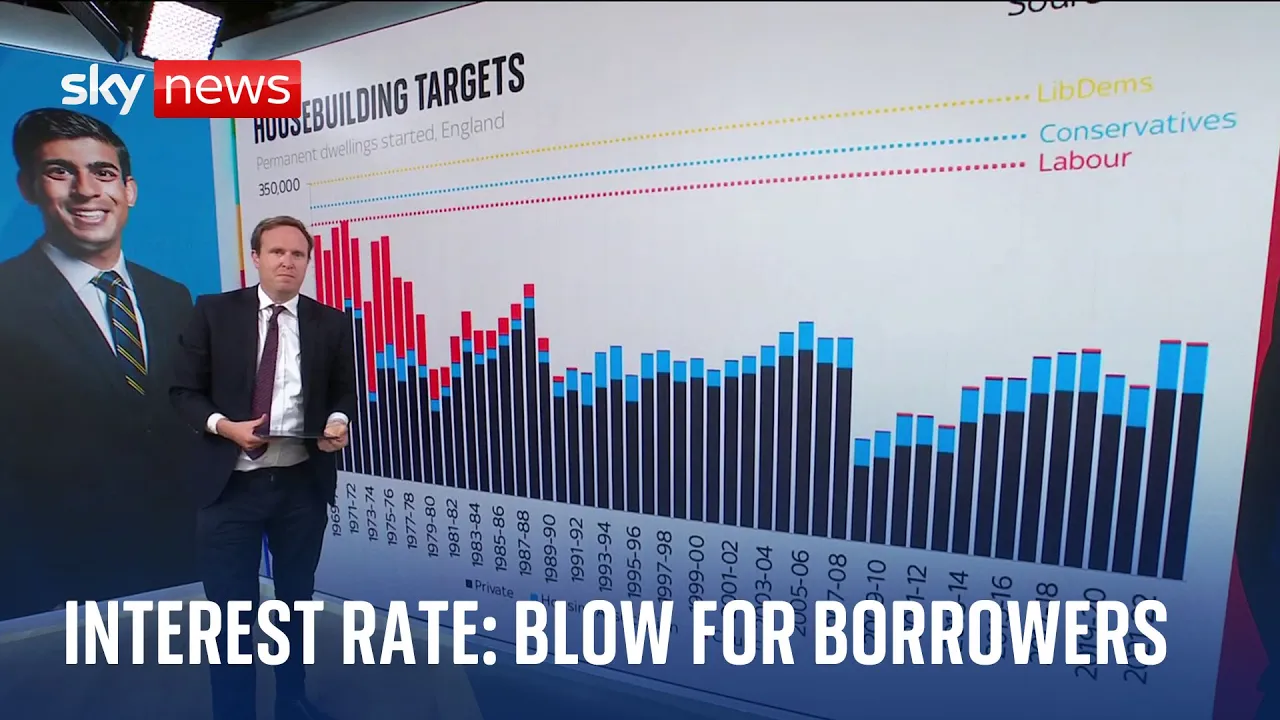

The Housing Supply Challenge

One of the most significant issues facing the UK housing market is the supply of new homes. Historical data shows a sharp decline in local authority housing construction since the 1970s.

Current Housing Construction Trends

Despite some increases in private sector housing, the overall construction of homes has not met the demand:

- Current average housing construction levels are around 300,000 homes per year.

- Previous peaks in construction during the 1970s saw levels around 400,000 homes annually.

Political Commitments to Housing Supply

As the political climate evolves, major parties have outlined their housing agendas:

- Conservatives: Aim to build 320,000 homes.

- Labour: Proposal for 300,000 new homes.

- Liberal Democrats: Ambitiously targeting 380,000 new homes.

However, there is skepticism regarding the feasibility of these targets without significant investment in council housing.

Conclusion

In conclusion, the interplay between interest rates, housing affordability, and political commitments significantly shapes the current UK housing market. As interest rates remain steady, the pressure on mortgage payers continues to mount, exacerbating affordability issues. It is crucial for prospective homeowners and renters to stay informed about these developments as political parties strive to navigate the complexities of housing supply. For more insights on housing policies and market trends, explore our related articles on housing finance and market forecasts.

“`