The Impact of Taxation and Public Spending in UK Politics

This article provides a comprehensive analysis of the taxation plans and public spending strategies proposed by various political parties in the UK. We will explore the historical context of tax burdens, party plans, and the impact on key sectors such as health and local government.

Introduction

The discussion surrounding taxation and public spending in the UK has become increasingly complex, especially in light of recent political debates. The tax burden has been on an upward trajectory since the end of World War II, prompting a need for clarity on party policies and their implications for the public. This article will dissect the current tax landscape, comparing the proposals of the Conservative Party, Labour Party, and Liberal Democrats, while also examining how these plans will affect various sectors of public life.

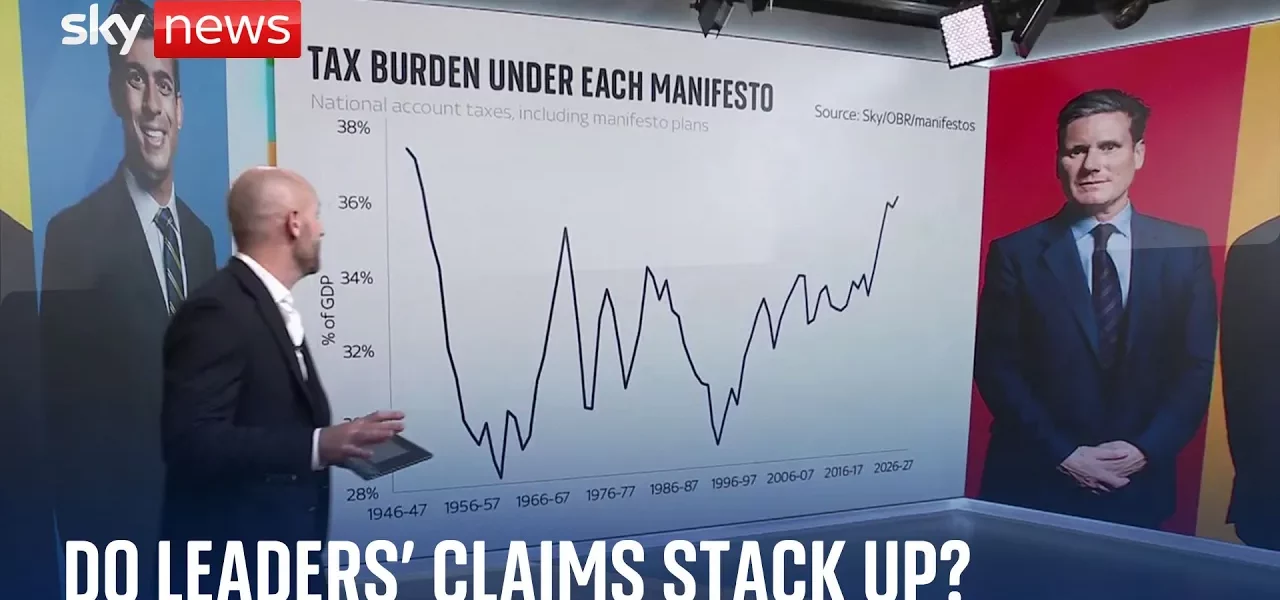

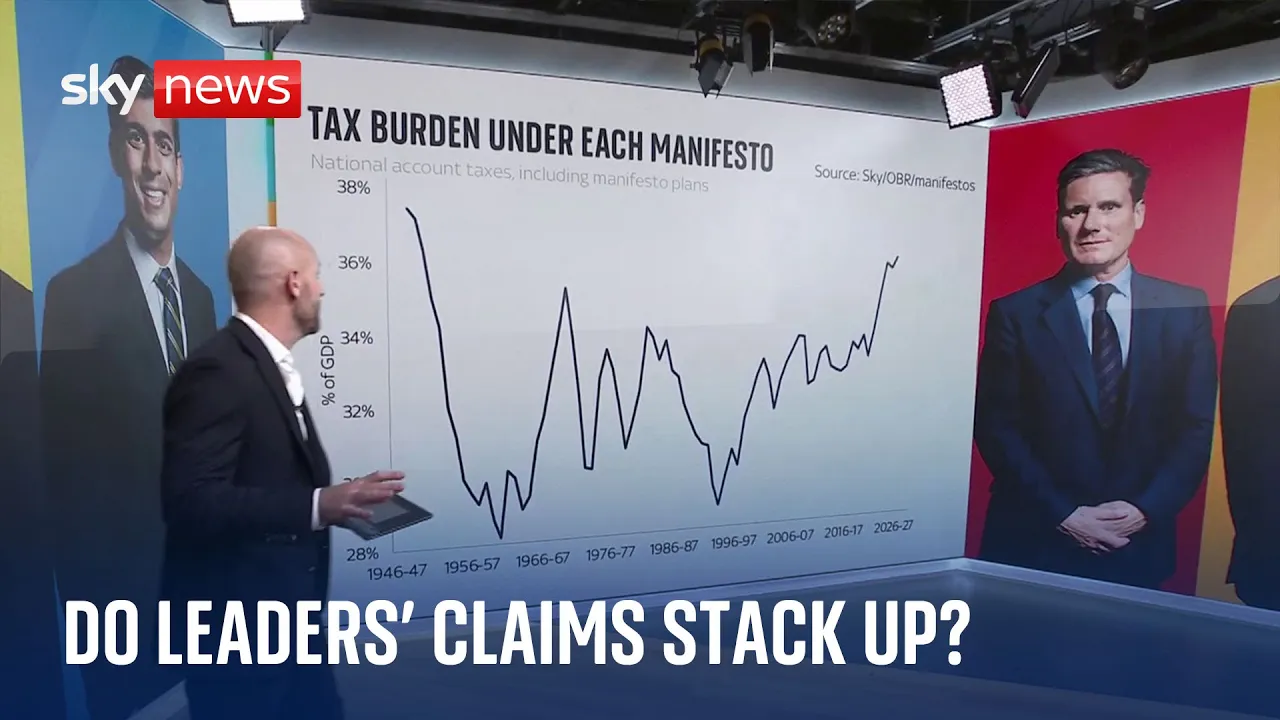

The Historical Context of Tax Burden

Understanding the historical tax burden in the UK is crucial for grasping current political debates. Since the end of World War II, taxes have steadily increased, reflecting various economic policies and governmental needs.

Post-War Tax Trends

After the war, the UK saw a gradual increase in taxation to fund reconstruction efforts and social programs. This trend has continued, with notable spikes during economic crises. The current tax burden is higher than ever, which has led to intense scrutiny of party proposals.

Party Proposals and Their Implications

Each political party has presented its vision for taxation and public spending, leading to significant discourse about their potential impact on the economy and public services.

Conservative Party Plans

The Conservative Party’s plans suggest a slight reduction in current tax levels, yet the overall tax burden is expected to rise. This paradox raises questions about the sustainability of public spending.

Labour Party Proposals

Labour’s manifesto outlines a more progressive approach, with plans for increased spending on essential services while aiming to keep tax increases lower than those proposed by the Conservatives. A key aspect of Labour’s strategy involves borrowing and private financing, aimed at funding major projects.

Liberal Democrats’ Approach

The Liberal Democrats have also presented a unique perspective, advocating for a balanced approach to taxation and spending. Their proposals focus on protecting vital services while ensuring a fair tax system.

Key Areas of Spending and Cuts

While all parties agree on a 1% increase in day-to-day public spending, the allocation of these funds is where significant differences arise.

Protected vs. Unprotected Areas

Protected areas, such as the NHS and defense, are set to receive increases in funding. However, unprotected areas, including local councils and law courts, are facing potential cuts, raising concerns about the impact on essential services.

- NHS: Expected to see continued funding increases.

- Defense: Maintained funding levels amidst rising global tensions.

- Local Government: Facing significant cuts, potentially leading to service reductions.

Green Spending Initiatives

Labour’s manifesto includes ambitious green spending plans that aim to transition the UK towards a more sustainable economy. However, the projected figures have been debated, with many analysts questioning the feasibility of these plans.

Public Sentiment and Taxation

The perception of taxation among the public plays a crucial role in political strategies. Current polling indicates that tax is not a top priority for voters compared to issues like the economy and health.

- Economy

- Health

- Immigration and Asylum

- Taxation (ranked lower)

This ranking suggests that while taxation is a critical issue, it may not resonate as strongly with the broader electorate as party leaders hope.

Conclusion

The ongoing discussions about taxation and public spending reflect deep-seated concerns about the future of public services in the UK. As parties present their plans, it is essential for voters to critically assess how these proposals will affect their lives. The stark contrast between party approaches will likely influence the upcoming elections significantly. For those interested in understanding the nuances of these political strategies, staying informed through reliable sources is crucial.

For more insights on UK politics and public policy, explore our related articles on taxation and government spending.

“`